Value is a very abstract term. It can be related to morality, ethics and money at the same time. Google gives us the following definitions of value:

Value:

1. the regard that something is held to deserve; the importance, worth, or usefulness of something.

2. principles or standards of behavior; one’s judgement of what is important in life.

3. estimate the monetary worth of.

4.consider (someone or something) to be important or beneficial; have a high opinion of.

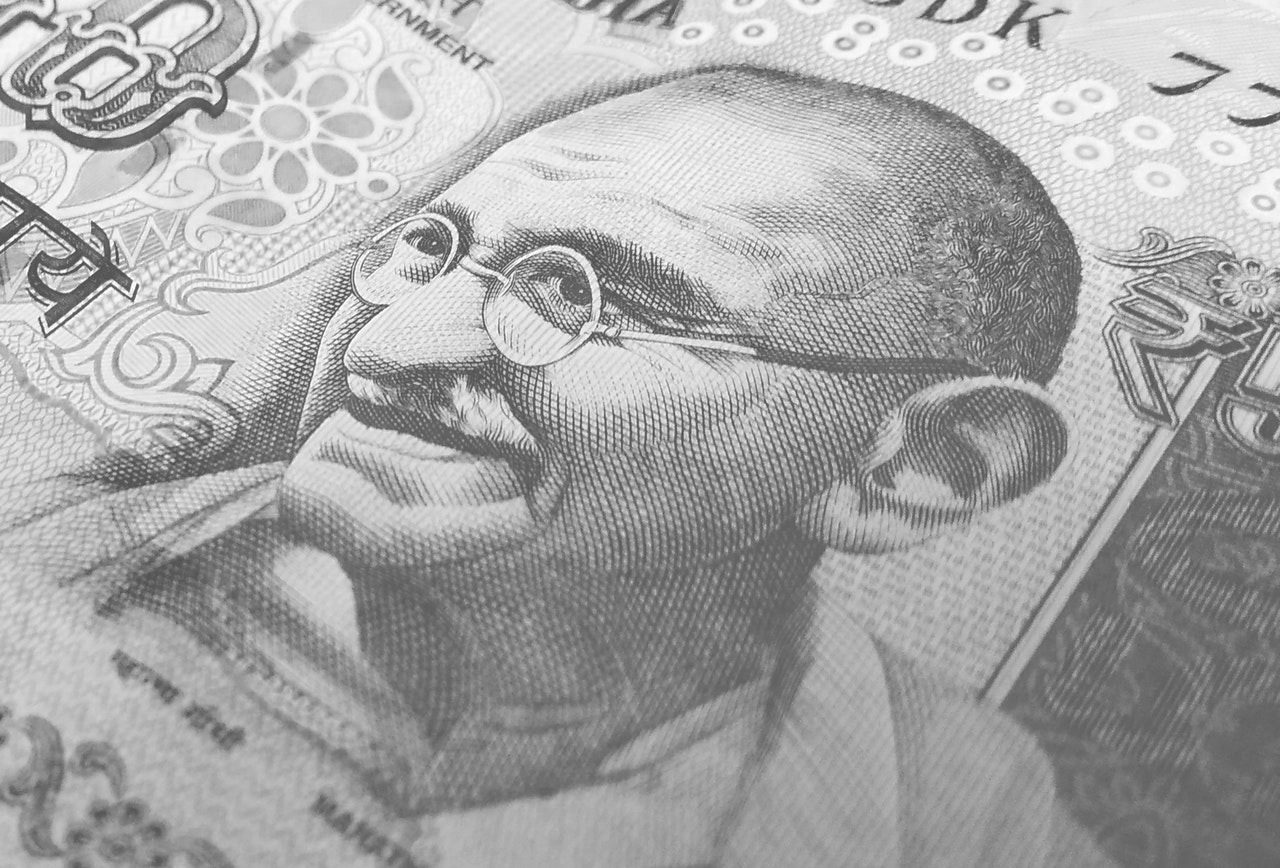

This being a personal finance blog, the 3rd definition is our prime focus. We would try to understand what does ‘Value” mean for the personal finance domain and why a better understanding of it goes a long way in securing financial independence for you and your family.

There Ain’t No Such Thing as a Free Lunch

Often, we are lured to things that are free. We all want free things. Heck, Kejriwal just announced free electricity, water and wifi and won the Delhi elections with a landslide margin. There is a very popular saying – “There Ain’t No Such Thing as a Free Lunch”. What this essentially means is that everything that we do has a certain value attached to it.

Let us understand using an example. Using social media sites is free, however, you could do something productive in that time. You could use that time to learn something, take an online course and prepare yourself for a better career. You can take a part time job and use that money to pay your debt faster. If you have no debts, you can use that money to build your investment portfolio or simply save for a rainy day.

Suppose, you spend 1 hr each day on social media, and using that time on a productive course, you upgrade your skills and earn Rs 200 by freelancing, that amounts to Rs. 6000 per month. If you invest Rs 6000 per month in mutual fund returning 12% average returns for 5 years, that could accrue close to Rs 490,000. Suppose, you keep investing for 10 years, it would grow to Rs. 1, 380,000.

Does this mean we should not ever use social media? No, as we initially said, everything has an inherent value. You and I derive a certain amount of pleasure from the use of social media. For many of us, it has become a primary source of news and staying in touch with our friends and family. Thus, we do get “value” from our use of social media. However, it may not be the best value that we can get for our time.We may want to limit out social media use and focus our efforts on maximizing value in the long term.

How does the concept of “Value” can be better applied to personal finance? Of course, above example would be relevant. Personal finance is concerned with maximizing the value you get out of each rupee you spend. So, understanding the value of our different spends is critical to the success of our long term goal of being financially independent. A simple example to understand this is the following choice – Would you rather eat out for dinner or prepare you own meal? Eating dinner out would save you the effort in cooking and cleaning utensils afterwards. Cooking your own dinner can save you money and then some in taxes. Remember, India is a heavily taxed country.

There can be numerous such examples from different aspects of our life, wherein we can save money with very little physical work. Some situations don’t even require physical work. It is just a decision where we need to delay our buying something and save/invest that money instead. For example, you could defer buying new clothes by few months or for as long as you don’t really need them. This could save you some real cash. You can be punctual at your office or when you are traveling. This way you don’t miss your flight due to traffic and pay outrageous last minute charges and destroy your budgets.

I hope you can clearly understand the concept of value and this article gave you some insights on how to utilize things to their maximum value.Let me know what you think of this article in the comments below. If you find this article useful, please share this with your friends.